Not known Details About Dubai Company Expert Services

Wiki Article

Dubai Company Expert Services for Beginners

Table of ContentsDubai Company Expert Services Fundamentals ExplainedThe Basic Principles Of Dubai Company Expert Services Some Of Dubai Company Expert ServicesDubai Company Expert Services for BeginnersDubai Company Expert Services for Dummies

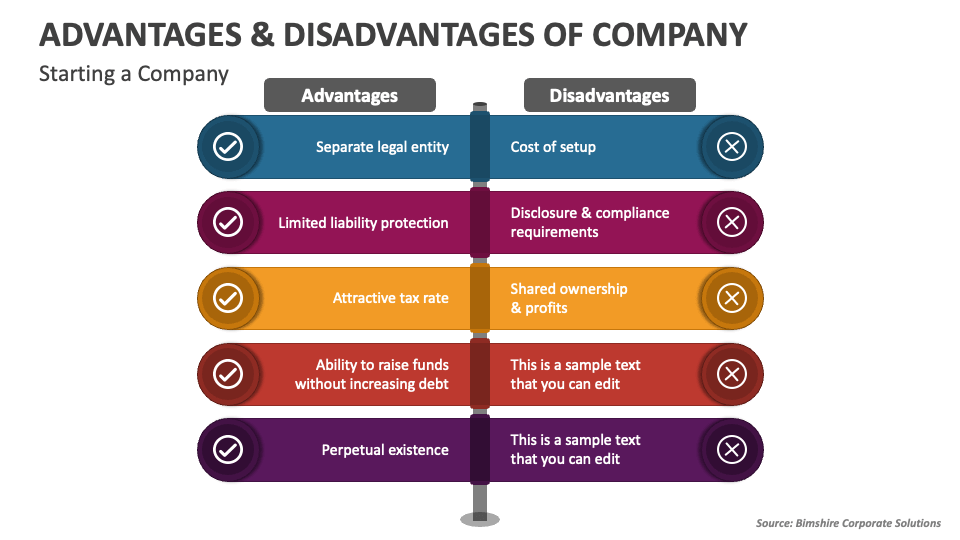

If one shareholder has greater than 25 percent of the shares, they are dealt with in business regulation as 'persons of significant passion' because they can affect decisions made concerning business. Exclusive restricted firms provide a variety of essential advantages contrasted to companies running as sole traders. As a single trader, you are directly accountable for all the financial obligations and also obligations of your organization.That minimizes the threat of having your individual possessions took to pay for the financial obligations of the company if it falls short. An exclusive minimal business is viewed as even more considerable than companies run by a sole trader.

Connected: What is EIS? - alternative funding alternatives for local business Connected: What is SEIS? - Different little company funding Sole traders pay revenue tax and National Insurance payments on the revenues of the company via a yearly self-assessment income tax return. Dubai Company Expert Services. The price of earnings tax and also National Insurance coverage payments amounts that of a personal individual and also includes the very same personal allowances.

You can additionally increase resources by offering shares in your organization, although you can not use them for public sale. Related: An overview to crowdfunding and the ideal crowdfunding sites UK When you register your company name with Firms Home, the name is protected and also can not be used by any type of other business.

Not known Factual Statements About Dubai Company Expert Services

If Companies Home acknowledge a matching name or a name that is very similar, they will certainly suggest the company as well as reject to grant consent. This level of defense makes it challenging for other business using duplicates of your items can not 'pass-off' their items as genuine. Related: Lawful elements of beginning a tiny company.As returns are tired at a reduced price, this will certainly minimize your tax obligation bill and offer a much more tax effective technique of reimbursement contrasted with income alone. There are likewise various other methods to take money out of business as a director, consisting of reward settlements, pension contributions, directors' finances and also personal financial investments.

Sole traders do not have the very same versatility. They take revenue from the profits of the service and also the income is tired at conventional personal income prices.

It exports nearly S$ 500 billion worth of exports each year with the result that this country with only 5. 25 million people has actually accumulated the 10th biggest international money gets in the world.

Some Ideas on Dubai Company Expert Services You Should Know

In a similar way, the individual tax obligation price begins at 0%, climbs really progressively to an optimum why not look here of 20% for earnings above S$ 320,000. Business profits are not double strained when they are passed to investors as returns. Simply put, dividends are dispersed to investors tax-free. Singapore bills one of the most affordable value included tax obligation rates in the world.These contracts are designed to guarantee that financial deals between Singapore as well as the treaty country do not endure from double taxation. Additionally, Singapore provides Independent Tax Credit scores (UTCs) for the case of countries with which it does not have a DTA. Thus, a Singapore tax resident firm is very not likely to deal with dual taxes.

You do not require any type of neighborhood partners or investors - Dubai Company Expert Services. This allows you to start a company with the sort of funding framework that you prefer and also disperse its ownership to match your investment demands. There are no constraints on the amount of funding that you can bring from your home nation to invest in your Singapore business.

No tax obligations are troubled capital gains from the sale of a service. In a similar way, no tax is imposed on rewards paid to the investors. Singapore does not enforce any kind of limitations on the activity of international money right into or out of the country. This frictionless motion of funds throughout boundaries can give severe flexibility to a company.

The Of Dubai Company Expert Services

For nine successive years, Singapore has actually ranked number one on Globe Bank's Ease of Doing Organization survey. It takes much less than a day to integrate a brand-new business.

The port of Singapore is one of the busiest in the entire world As well as is identified as a major International Maritime. Singapore's Changi Flight terminal is a top quality airport that caters to around 20 million passengers annually and also gives convenient flights to almost every significant city in globe.

Singaporeans are several of the most productive as well as well skilled employees on the planet. The country's outstanding education system creates a labor force that is good at what it does, yet on wages it is incredibly affordable with various other nations. Singapore is regarded as a rule following, well-functioning, modern and truthful country.

By locating your service in Singapore, our website you will certainly signify professionalism and high quality to your clients, partners as well as providers. The first impression they will have of your company will certainly be that of an expert, experienced, straightforward, and also well-run company.

The Best Guide To Dubai Company Expert Services

Think about the following: The civil liberties as well as lawful responsibilities of those that take part in business That controls the company as well as the degree of control you wish to have Just how complicated you desire the firm's structure to be The lifespan of business The finances, including tax obligations, financial debt, and liabilities Your above considerations will certainly figure out the type of business you'll produce, however you must most likely obtain legal guidance on the very best kind of business for your scenario.

This is one of the easiest means to begin a service as well as the most common type of business. In this kind of arrangement, individuals may equally separate the revenues and losses and also carry the obligation, unless a look at here written agreement defines exactly how these things are to be shared.

Report this wiki page